Most new real estate investors fail. But why?

- They do not understand their numbers.

- They do not include proper assumptions for vacancy, management, maintenance and changes in interest rate.

- They value appreciation over cash flow.

- They listen to their family and friends.

- They do not know what to look for during due diligence.

- They do not know how to write offers to protect themselves.

- They limit themselves to their local market.

- They do not understand how credit works.

- They do not know how to screen tenants.

- They do not understand residential tenancy rules and procedures where they invest.

If you do not know what you are doing, you can lose a lot of money very quickly buying real estate. If you want to invest in real estate, you need to learn the basics.

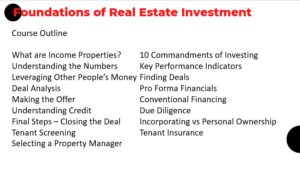

This course is presented over 6 evenings sessions, 2-3 hours per session, or over a 2 day weekend. It is given online, live, in small groups of no more than 10-12 students, so that time can be spent looking at transactions that students are working on.

By the end of this course, the student will:

- understand a property income and expense statement;

- be able to run the numbers, and assess deals quickly;

- be able to find potential deals;

- be able to write offers;

- understand financing and credit;

- understand the different structures for holding real estate;

- know what is required for due diligence;

- know how to screen tenants; and,

- know how to find and select a property manager.